Global art sales rose to $67.8 billion in 2022, according to art economist Clare McAndrew’s latest state-of-the-industry report for Art Basel and UBS Group. That marked a 3% increase from 2021, which saw a 31% rebound in sales from the pandemic-induced low point in 2020.

As in the global luxury sector, it was the US market that drove the art industry last year. Andy Warhol’s Shot Sage Blue Marilyn, which sold for $195 million in New York in May, became the second-most expensive work ever to sell at auction behind Leonardo Da Vinci’s Salvator Mundi, which sold for $450 million in New York in 2017.

Although the US retained its premier position in the global ranks, it’s notable that the UK also strengthened. The British art market hasn’t quite recovered to pre-pandemic levels, but it is still attracting international buyers post-Brexit. The slump in sterling last autumn didn’t hurt either.

Across all regions, the most expensive artworks were the strongest sellers, according to McAndrew’s Arts Economics. Pieces selling for more than $10 million were the only segment to increase the value of sales last year. This category includes Georges Seurat’s Les Poseuses, Ensemble (Petite Version), which sold for $149.2 million, and Paul Cezanne’s La Montagne Sainte-Victoire, which fetched $137.8 million. This top-end surge reflects increasing stores of wealth among the very richest collectors.

In contrast, stalled demand for lower-end works suggests that fear of recession, sky-high inflation and rising interest rates crimped the style of those merely affluent. The market began to cool in the final quarter of 2022.

What’s happening in art echoes what’s happening in the luxury sector more broadly.

After soaring stock markets and cryptocurrencies boosted wealth in 2021, more people, particularly in the US, discovered the joys of upmarket shopping. But with the slump in tech stocks and Bitcoin, as well as higher borrowing costs, luxury companies including Britain’s Burberry Group and Gucci-owner Kering have noted that some younger, more aspirational buyers, are reining in their extravagant purchases.

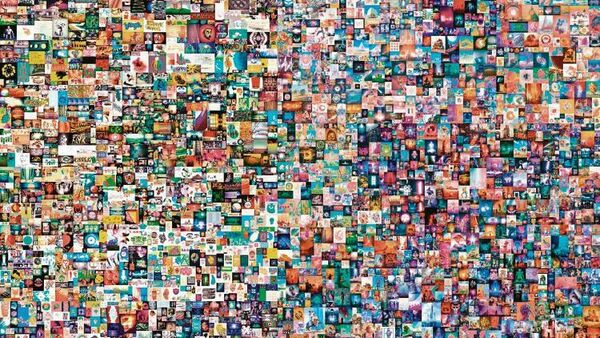

In art, this is glaringly evident when it comes to non-fungible tokens (NFTs), digital certificates of authenticity that run on blockchain technology. With crypto bros spending their gains on NFTs alongside Audemars Piguet watches, sales of art-related tokens surged to $2.9 billion in 2021, from $20 million in the year earlier, according to Arts Economics, with data from Nonfungible.com. The boom was best exemplified by Beeple’s Everydays: the First 5000 Days, which sold for $69.3 million two years ago.

After peaking in August 2021, demand for art-related NFTs cooled as the price of Ethereum—the cryptocurrency of choice for trading most of these tokens—fell. Art-related NFT sales roughly halved in 2022 from the year earlier, though sales of collectibles NFTs have continued to expand.

Some young people are buying art as much as ever, but a separate report from McAndrew for Art Basel and UBS found that they were high-net-worth individuals, with more than $1 million of assets excluding real estate and private businesses, and they had spent at least $10,000 on art in each of the past three years. These millennial and Gen Z buyers look a bit different from crypto bros.

The question now is: How will the recent banking turmoil affect the art market?

In troubled times, art can be seen as a tangible store of value. But stock-market volatility and layoffs in the tech sector and beyond can hurt demand. External crises can also deter sellers of valuable works from bringing them to market, another important factor in determining the strength of art sales globally.

Either way, with the US cooling, China now holds the key to transforming both art and luxury.

Arts Economics notes that after the 2008 crisis, a booming market in China was one of the key factors behind the recovery, with sales rebounding in 2010. Already the signs there are promising. Art Basel Hong Kong last month was busy, indicating that there is significant pent-up demand for art.

This adds to positive signals from brands including Prada and Moncler that luxury shoppers are back in force too. Analysts at Bernstein even noted that some Chinese fashionistas had begun to travel abroad again. For sellers of creations by Balenciaga and Basquiat, Chinese shoppers unleashing another wave of revenge spending can’t come too soon.

Andrea Felsted is a Bloomberg Opinion columnist covering consumer goods and the retail industry.

Download The Mint News App to get Daily Market Updates.

More

Less

#Topend #art #luxury #zoom #crypto #bros #dump #NFTs