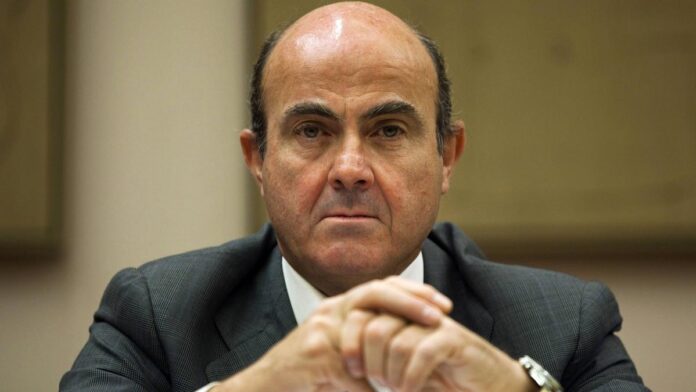

File photo of ECB vice-president Luis de Guindos.

| Photo Credit: Reuters

The European Central Bank (ECB) is monitoring broad risks across the financial sector and will act to preserve stability in the euro area, ECB vice-president Luis de Guindos said in a speech on April 1.

Mr. De Guindos provided reassurance on the established banking sector in the single currency zone, saying banks had strong capital and liquidity positions but he warned of wider dangers elsewhere in the system.

“…In our view, vulnerabilities in the financial system prevail in the non-bank financial sector, which grew fast and increased its risk-taking during the low interest rate environment,” De Guindos told the Ambrosetti business forum in northern Italy.

He said policy reforms to address these vulnerabilities were critical.

“Priority should be given to policies that help build resilience in the sector, such as by reducing liquidity mismatch, mitigating risk from leverage, and enhancing liquidity preparedness across a broad range of institutions,” he said.

The ECB has been raising interest rates to try to curb rising inflation but there have been concerns that these higher borrowing costs are fuelling turmoil in the financial markets.

Mr. De Guindos said that headline inflation was likely to decline considerably this year but underlying inflation dynamics would remain strong.

“The feedback between higher profit margins, higher wages and higher prices could pose more lasting upside risks to inflation,” he said.

#ECBs #Guindos #warns #broad #risks #financial #sector